Iran is a country in Western Asia. Comprising a land area of 1,648,195 km2 (636,372 sq mi), it is the second largest country in the Middle East and the 17th largest in the world. With an attractive business environment for investment, and having considerable potentials and advantages such as strategic geopolitical situation, climate diversity, economic advantages, energy security and domestic and regional markets, Iran is one of the best choices for your investment.

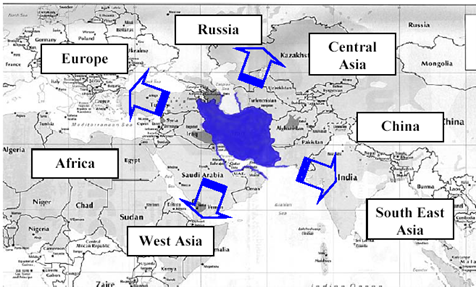

Geopolitical Situation

Iran with unique geographical location at the heart of a cross-road linking the Middle East, Asia and Europe, empowered by inter and trans-regional trade, customs, tax and investment arrangements.

Having common border on the north by the Caspian Sea and on the south by the Persian Gulf and the Oman Sea, has allowed Iran to access more than 5,800 km of coastal strip. Iran has a privileged position in transit, since having access to the Eurasian countries from the north, east to the Central Asian countries and from the West with a land border with Turkey and thus using a part of the Silk Road.

The geographic location over the transatlantic crossroads has turned the country to the transit axis on the North-South and East-West corridors and so it plays an important role in international economy.

Climatic Characteristics

Iran is one of the world’s most unique countries, in terms of climate with four desirable seasons. There are many climate varieties in Iran and from the word 14 climate, Iran favors 11 climates. This climate diversity has led to a variety of natural landscapes, which can hardly be seen in other countries. Iran has varied nature and climate contains abundant plants and animals which are amazing in both number and variety in comparison with other parts of the world. Iranian Vegetation diversity is more than twice the size of Europe continent and nearly equals the Indian subcontinent.

Energy Security

Compared to the oil and gas producing countries, Iran is ranked 2nd in total proven oil and gas reserves after Russia. This global position allows maximizing national security by providing appropriate strategies for energy security.

Young Educated Human Resources

With its young population and significant part of which are educated and knowledge-based, Iran has specific labor force conditions that are rarely seen in other countries.

Domestic and Regional Market

Iran ranks the world 18th with over 80 mn population and is the second most populous country in the Middle East. There are large middle classes with increased income distribution equality and changing consumption patterns, with annual household net expenditure increasing rapidly.

Surrounded by the consuming countries, which lack the sufficient infrastructures for industrial development, Iran can hold the main part in importing required goods. Additionally, Iran plays a key role since being as a linking chain of North to South and East to West for the transit of goods, swaps (oil swap) and connectivity to international electricity transmission networks.

Iran Economic Advantages

- The 18thlargest Economy in the World by Purchasing Power Parity (PPP)

- The Diversified Economy and Broad Industrial Base directly involved in Tehran Stock Exchange (TES) and Iran Fara Bourse (IFB) are the Largest Industrial Base in the MENA region

- Rich in Natural Resources

- Labor-Rich Economy

- Young and Educated Population

- Large Domestic Market

- The Middle East market as a Prime Market Opportunity for Iran’s Non-Oil Exports

- Developed Infrastructure in Transportation, Telecommunications and Energy

- Strategic Location, surrounded by 15 Land and Sea Neighbors, Serve as a Lucrative Trade and Transit Route in Both North-South and East-west Directions

- Tax Exemptions and Incentives

- Diversified hydrocarbon-rich economy

- 4thOil Producer in the World

- 2ndGas Reserves in the World

- One of the Top Producers of Zinc, Lead, Cobalt, Aluminum, Manganese and Copper in the World

- Ranks amongst the Top 7 Countries in Producing 22 Important Agricultural Products

|

Infrastructure and Population

|

|

Sector

|

Capacity

|

|

Population

|

82820766

|

|

Telephones-main lines in use

|

30944169

|

|

Telephones-mobile cellular

|

88341723

|

|

Airports

|

319

|

|

Railways

|

13437 km

|

|

Roadways

|

232535 km

|

|

Electricity-production

|

304.4 billion kwh

|

New fields of Investment Opportunities & Priorities

Setting up the rating agencies

Establishing foreign financial institutions

Establishing Clusters for Export, Trademarks in agricultural products

Development of at least 54 Rural Business Clusters

Construction and Operation of 98 Rural Industrial Area

Development of modern irrigation methods

Development of fisheries and fish farming in cages

Water desalination and Sewage.

Urban wastewater system network, recycling and management of waste and sewage.

New petrochemical products

Construction of power plants with efficiency of 55% to 60%

PPP Projects

Renewable Energy.

Electronic trading

ICT infrastructure development in rural area

Knowledge-based companies (start-up’s)

Urban and suburban rail transport

New small ports

Exploration, production and utilization of oil and gas fields

Appropriate Tax Regime

Highlights of Tax Holidays

|

Income Tax with 0.0% Rate

|

Duration of Exemption

|

|

Industry, Mining & Services (Hospital & Hotels)

|

5 Years

|

|

Industry, Mining & Services (Hospital & Hotels) in Industrial Parks and Special Economic Zones

|

7 Years

|

|

Industry, Mining & Services (Hospital & Hotels) in Less Developed Areas

|

10 Years

|

|

Industry, Mining & Services (Hospital & Hotels) in Less Developed Areas located at Industrial Parks and Special Economic Zones

|

13 Years

|

|

All economic activities in Free Trade Zones

|

20 Years

|

|

100% of Income derived from Agricultural Activities

|

Perpetual

|

|

100 % of Income derived from Export of Services ,Non-oil goods, Agricultural Products and 20% of Income derived from Export of Non – Processed goods

|

Perpetual

|

In companies with more than 50 employees, in case of increasing the employment volume up to 50% in comparison to last year, one-year exemption will be added to the duration of exemptions period mentioned above.

In case, foreign companies with reliable Brand produce goods using production capacity of Iranian companies and export at least 20% of total production can enjoy 50% exemption on Tax Rate for the income derived from sales of products (it means total tax rate will be12.5 % instead of 25%) after the end of above duration.

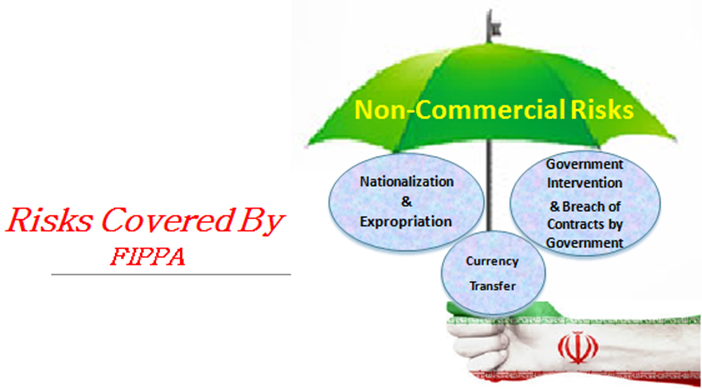

Appropriate Investment legislation

The legal framework of foreign investment regime in Iran is defined under the Foreign Investment Promotion & Protection Act (FIPPA).

FIPPA, is ratified in 2002 and replaced its predecessor LAPFI (which was in effect since 1955) to further improve the legal framework for foreign investments in Iran.

Some features of investment under FIPPA:

No Limitation on:

Equity Percentage

Volume of Investments

Profit Transfer

Capital Repatriation

Types of Capital Imported

Types of investment (Direct Investment (Equity Participation) in All Areas Open to Iranian Private Sector in Greenfield & Brownfield Projects & Investment through Contractual Arrangements)

No Import / Export Restriction

Equal Treatment towards Foreign Investors as accorded to Local Investors

International Treaties

Bilateral Investment Treaties (BITs) with 70 Countries

Double Taxation Treaties (DTTs) with 42 Countries

Full Government Support & Services

Providing:

Free of charge before and after care

Services to foreign investors

3 years’ multi-entry Visa.

3 years’ residence permit.

Work permit.

Covering political risks for foreign investments.

To facilitate the Foreign Investment procedures in Iran, OIETAI provides investment services with a One-Stop-Shop approach in its “Foreign Investment Services Centre” (FISC) at the national level and in 31 provincial Investment Service Center.

Investment Promotion Agency (IPA)

The Organization for Investment, Economic & Technical Assistance of Iran (OIETAI) founded in June 1975 and is the sole official authority for the promotion and protection of foreign investments in Iran.

As the main investment authority, OIETAI is responsible for receiving and processing foreign investment applications.

OIETAI also presents investment opportunities to potential foreign investors and supports them by assisting, coordinating and facilitating all issues pertaining to their investments throughout the licensing process and ever after and other issues related to Foreign Investment in the country such as:

Admission, Importation, Utilization, Repatriation

Performing and conducting foreign investment promotion activities

Introducing legal grounds and investment opportunities,

Carrying out studies and applied researches,

Organizing conferences and seminars,

Cooperating with the relevant international organizations and institutions,

Establishing relations and coordination with other agencies in gathering, compiling and providing information related to Foreign Investment

The OIETAI’s management and staff welcome the prospective investors and gladly provide them with any information and/or assistance required, by way of the following addresses:

Tel: (+9821) 39902485

(+9821) 39902486

(+9821) 39902488

(+9821) 39902115

(+9821) 39902001

(+9821) 33967755

(+9821) 33967075

(+9821) 33967749

(+9821) 33967762

Fax: (+9821) 33967864

(+9821) 33967774

Website: www.investiniran.ir

Address: OIETAI, Building No 4, Davar Street, 15 Khordad Square, Tehran, Iran.

Organization for Investment, Economic and

Technical Assistance of Iran (OIETAI)

Tehran – Islamic Republic of Iran